Bounce Back at the Bourse

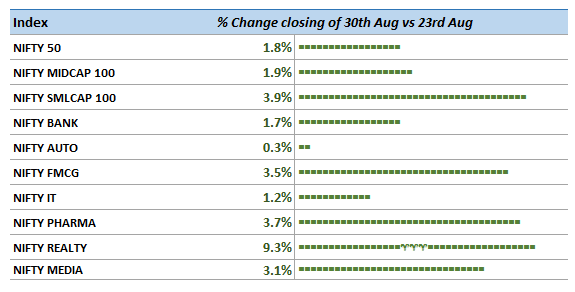

Comparison of indices – closing 30th August vs 23rd August

Nifty50 regained 11000 with a 1.8% jump during the week. Midcap (up 1.9%) and Smallcap (up 3.9%) outperformed Nifty. All major sectoral indices were positive led by Realty (+9.3%), Pharma (+3.7%), FMCG (+3.5%).

Market Updates:

- India’s GDP growth at 5% – As a result of significant slowdown in manufacturing output and subdued farm sector activity, India’s GDP growth hit six-year low of 5% in Q1 of FY2019-20

- Govt eases FDI norms – Government has liberalized FDI norms in four sectors. Union Cabinet has allowed 100% FDI in coal mining and contract manufacturing; approved 26% overseas investment in digital media; in single-brand retail trading (SBRT), the definition of 30% local sourcing norm has been relaxed and online sales permitted without prior opening of brick and mortar stores.

- Moody’s: Loan growth to get a boost – Finance Minister had announced upfront capital infusion of Rs 70,000 crore into public sector banks (PSBs). The move is expected to generate additional lending and liquidity in the financial system to the tune of Rs 5 lakh crore. This will allow PSBs to grow loans by around 13-15% in the current financial year (FY20) compared to ~10% in fiscal 2019

Recent Comments