Equity Market Commentary for the week

- Indian markets settled higher at the end of another range bound week.

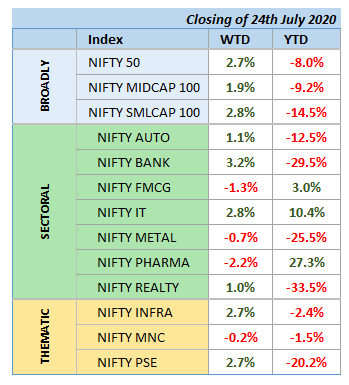

- The Nifty ended with a weekly gain of 2.7%, whereas Bank Nifty has ended 3.2% higher.

- Markets continued to trend higher during the week with Nifty50 closing above the important psychological level of 11,000 (11,194)

- Sectoral front: it was a mixed bag with Bank showing major weekly gains – up 3.2% following by IT – up 2.8% and Infra – up 2.7%. Investor favourites – Pharma registered weekly loss of 2.2% and FMCG was down 1.3%

Debt and Commodity Market Commentary for the week

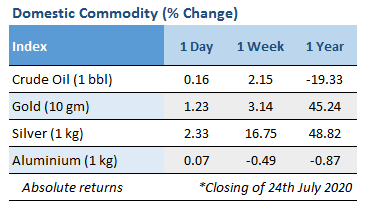

- Bond yields fell on anticipation of bond supportive steps from RBI in the coming months to ease oversupply concerns. Yield on the 10-year benchmark paper (5.79% GS 2030) closed at 5.80% after moving in a range of 5.80% to 5.82%.

- Gold prices rose as escalating tensions between U.S. and China boosted its safe haven appeal.

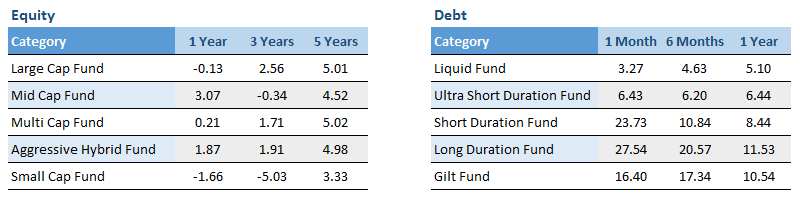

Category wise performance of mutual funds

1. Equity: Less than 1 year return are absolute and greater than 1 year returns are CAGR;

2. Debt: Less than 1 year return are simple annualised and greater than 1 year returns are CAGR;

1. Equity: Less than 1 year return are absolute and greater than 1 year returns are CAGR;

2. Debt: Less than 1 year return are simple annualised and greater than 1 year returns are CAGR;

Recent Comments