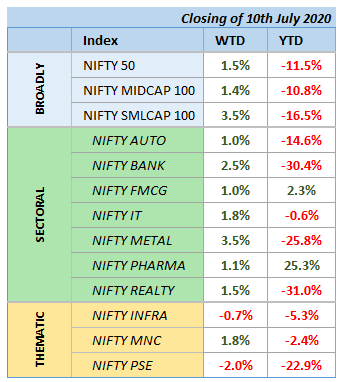

Equity Market Commentary for the week

- Indian equity markets made small gains during the week. Steep

rise in covid-19 cases both in India and globally continued to weigh on investor sentiment. - Market sentiments boosted after PM said at the India global Week Summit that India is seeing green shoots of economic recovery.

- Metal sector rose with steel prices gaining on demand prospects and low China stockpiles due to flooding in South China.

- Banking stocks remained in focus on reports that government may tell IBA to set up bad bank with financial support from banks, instead of asking the government to become a promoter.

- Sectoral front, majority of the sectors closed in the green. Metal was the top gainer, up 3.5%, followed by Bank and IT that rose 2.5% and 1.8%, respectively.

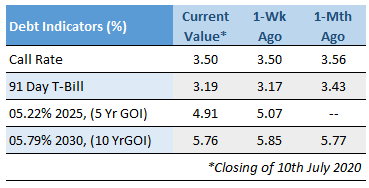

Debt Market Commentary for the week

- Bond yields fell for the second consecutive week on hopes that RBI will come out with more special open market operations to absorb the excess supply of sovereign debt. Hopes of further easing of monetary policy by the Monetary Policy Committee also contributed to the upside.

- Yield on the 10-year benchmark paper (5.79% GS 2030) fell 9 bps to close at 5.76% compared to previous close of 5.85% after moving in a range of 5.75% to 5.85%.

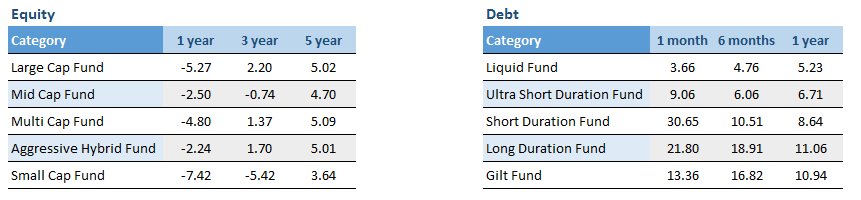

Category wise performance of mutual funds

1. Equity: Less than 1 year return are absolute and greater than 1 year returns are CAGR;

2. Debt: Less than 1 year return are simple annualised and greater than 1 year returns are CAGR;

Recent Comments