Managing Risks in Your Portfolio

In the earlier segment, we understood the different types of risk and how the most effective tool against it is diversification. Coming back to financial markets, what would be examples of individual and common risks?

Risks would cause returns from an instrument to be higher or lower than expected. Usually, stock prices and dividends fluctuate due to two types of news:

- Firm-specific news: This can be good or bad news about the company itself, be it change in management, a merger, etc.,

-

Market-wide news: it can be good or bad news about the economy as a whole and therefore affects the whole market. The RBI lowering the repo rate to boost the economy is an example.

Firm-specific risk is also called idiosyncratic, unique or diversifiable risk. These are unrelated across stocks, i.e., independent like thefts.

Market-wide risk is a common risk that like cyclones, simultaneously affects all stocks. This is called systematic, ‘undiversifiable’ or market risk.

When we combine many stocks in a large portfolio, the firm-specific risk for each stock will average out and be diversified. Some news can be good for a certain sector of stocks but bad for another. The amount of good or bad news is relatively constant. Systematic risk, on the other hand, will affect all stocks, and thus the entire portfolio. It cannot be diversified.

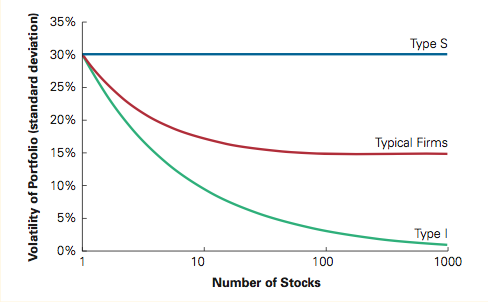

Consider a portfolio of Type S firms (blue line), these are fully diversified and now depend on the strength of the economy, i.e., solely face market risk. As with cyclone insurance, the volatility of the portfolio is constant, it does not change as the number of firms increases.

The portfolio of Type I firms (green curve) only face diversifiable risk, similar to theft insurance more risk is diversified as the portfolio size increases. When the number of stocks is large, we see that the risk for this portfolio is essentially eliminated.

In financial markets, as we see today, portfolios represent the red curve in the graph. They face both market and firm-specific risks. As a result, the volatility of the portfolio decreases only until the firm-specific risk is diversified away (as seen with the red curve falling), the market risk still remains (the line becomes constant after approximately 80 firms).

This answers the question we had posed initially — why big portfolios are less risky than its individual constituents. Individual stocks are subject to both firm-specific and market risks — the former can be diversified in a portfolio, the latter cannot.

Risk — love it, or hate it, you simply cannot ignore it!.

It’ll be nice to hear your experience of managing risks in your portfolio. Leave a comment

Ankita is a guest contributor of the article – Primer to Risk and Returns – I & II. She is an undergraduate student at Sciences Po Paris, studying political economy and economics. Currently on exchange in Singapore, she is majoring in finance and sociology. She enjoys having a well diversified portfolio when it comes to areas of study, which gives her a holistic take on financial topics

Recent Comments