A Cautious Slide

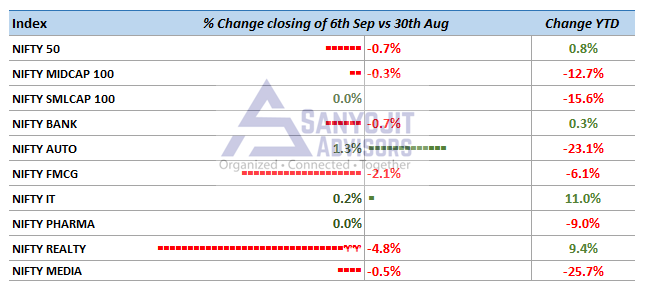

Comparison of indices – closing 6th September vs 30th August

Nifty50 fell short of 11000 and closed 0.7% below last Friday’s closing. Midcap (down 0.3%) and Smallcap (flat) fared better than Nifty. Amongst sectoral indices, Auto (+1.3%) and IT (+0.2%) gained. Most other sectors ended in red, with Realty (down 4.8%) and FMCG (down 2.1%) losing the most. We have added a YTD change column that charts YTD change as compared to closing of 31-December 18. We observe a significant under-performance of midcap and smallcap indices compared to Nifty 50.

Market Updates:

- FDI into India grows by 28% in Q1FY20 – FDI into India grows by 28% to $16.33 billion in Q1FY20. Sectors that have received maximum foreign investment include services ($2.8 billion), computer software and hardware ($2.24 billion), telecommunications ($4.22 billion), and trading ($1.13 billion)

- Govt to merge 10 PSBs to revive growth – Finance Minister has announced four new set of mergers — Punjab National Bank, Oriental Bank of Commerce and United Bank of India will combine to form the nation’s second-largest lender; Canara Bank and Syndicate Bank will merge; Union Bank of India will amalgamate with Andhra Bank and Corporation Bank; and Indian Bank will merge with Allahabad Bank. The exercise will bring down the number of nationalised public sector banks from 27 in 2017 to 12.

- CARE reduces India’s GDP growth for current fiscal – CARE Ratings has revised India’s GDP estimate downward from 6.7-6.8% earlier to 6.4-6.5% for current financial year (FY20) on account of subdued growth in the industrial sector and weakness in the agricultural sector.

Recent Comments