Deeper Red

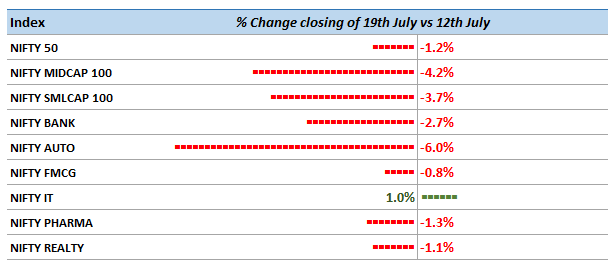

Comparison of indices – closing 19th July vs 12th July.

Further weakening

After moving upwards early in the week, Nifty50 fell sharply yesterday and today to close 1.2% below last Friday’s closing. Midcap (down 4.2%) and smallcap (down 3.7%) continued to weaken. Auto index was badly hit and closed 6% below. Bank (down 2.7%), Pharma (down 1.3%), Realty (down 1.1%) and FMCG (down 0.8%) were all in red. IT index ended 1% above last week’s closing.

Market Updates:

- Lower Growth Forecast: Asian Development Bank has reduced India’s GDP growth forecast to 7 percent for FY20, from 7.2 percent projected earlier, on the back of fiscal shortfall concerns.

- Auto industry sluggish Jan-Jun2019: Auto industry witnessed a sluggish rate of sales in the last two quarters. A net decline of 10.1% was registered in the rate of automobile sale during the period.

- MSME credit continues to grow: According to TransUnion CIBIL- SIDBI MSME Pulse Report, MSME credit continues to grow at a healthy rate signalling rapid revival. Lending to commercial entities (including MSME and corporate entities) has grown at a CAGR of 13.4% in last 4 years. The study shows that Gujarat has emerged as the top ranking state in terms of performance and growth potential for MSME lending in India followed by Andhra Pradesh, Haryana, Karnataka and Delhi.

Recent Comments