Equity Market Commentary for the week

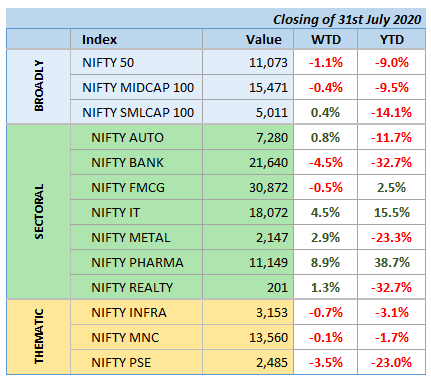

- Indian markets settled lower at the end of another range bound week.

- Nifty50 ended with a weekly loss of 1.1% whereas Midcap lost 0.4% and smallcap gained 0.4%

- An economic study by Dun & Bradstreet, Indian economy may continue to face inflationary pressure in the near term. However, it is likely to see a V-shape recovery in Q3/Q4 in FY20-21

- Sectoral front: it was a mixed bag with Pharma registering major weekly gains – up 8.9% followed by IT – up 4.5%. Bank registered weekly loss of 4.5%.

Debt and Commodity Market Commentary for the week

- Yield on the 10-year benchmark paper (5.79% GS 2030) closed at 5.83% after moving in a range of 5.82% to 5.84%.

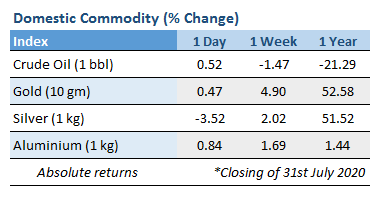

- Gold prices continued to rise last week, gaining 4.90%

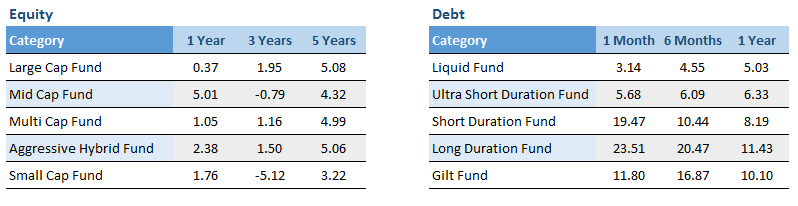

Category wise performance of mutual funds

1. Equity: Less than 1 year return are absolute and greater than 1 year returns are CAGR;

2. Debt: Less than 1 year return are simple annualised and greater than 1 year returns are CAGR;

1. Equity: Less than 1 year return are absolute and greater than 1 year returns are CAGR;

2. Debt: Less than 1 year return are simple annualised and greater than 1 year returns are CAGR;

Recent Comments